Solar Innovations and Trends

Your source for the latest in solar technology and energy solutions.

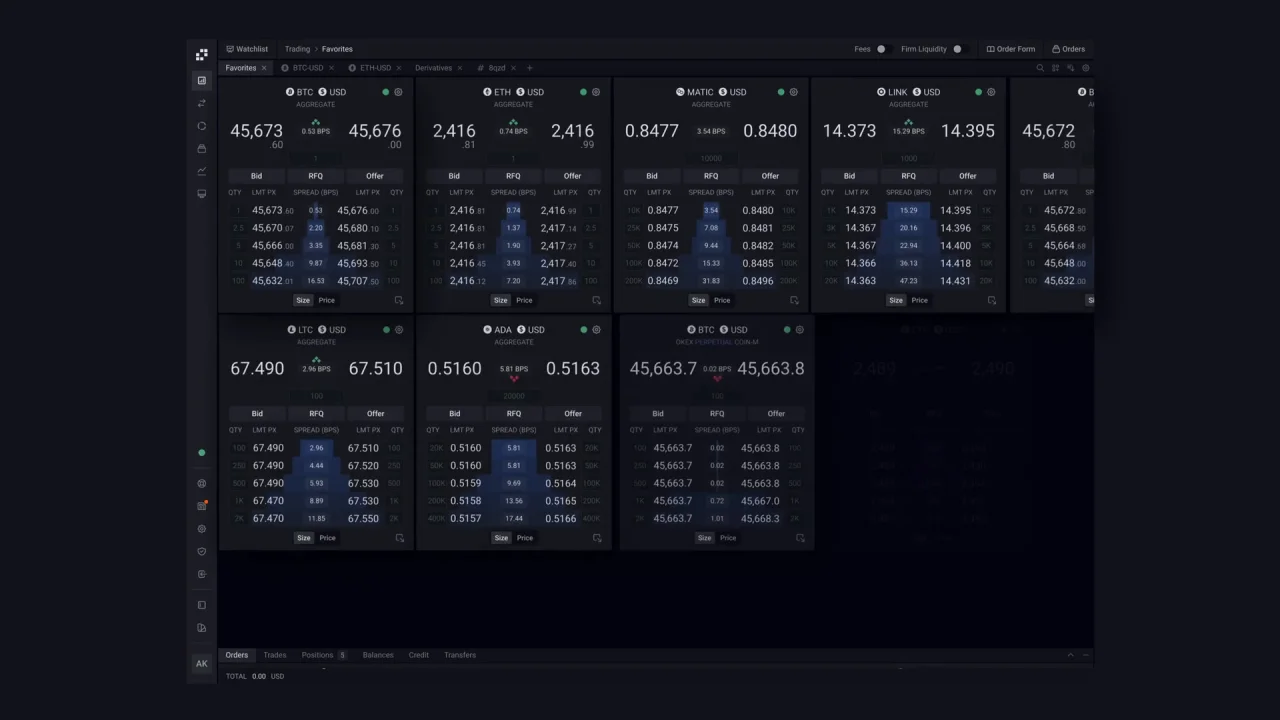

Trading Digital Assets: The New Gold Rush or Just Fool's Gold?

Discover if trading digital assets is the new gold rush or just fool's gold. Uncover insights, risks, and rewards in this booming market!

Understanding the Basics of Digital Assets: A Beginner's Guide

In today's digital age, digital assets have become a cornerstone for businesses and individuals alike. But what exactly are digital assets? At their core, digital assets are any content or file that exists in a digital format and holds value. This can range from cryptocurrencies and digital art to website domains and social media accounts. To truly understand their impact, consider how they can serve as investment opportunities or as tools for building brand presence online. Familiarizing yourself with the various types of digital assets is the first step in harnessing their potential.

As you begin your journey into the world of digital assets, it's essential to grasp some key concepts that govern their use and management. Here are a few important points to consider:

- Ownership and Control: Unlike physical assets, digital assets rely on access and ownership rights, often defined by platforms and blockchain technology.

- Valuation: The value of digital assets can fluctuate significantly based on market demand and trends, making understanding market dynamics critical.

- Security: Protecting your digital assets from theft or loss is paramount; consider using secure wallets and two-factor authentication.

By keeping these aspects in mind, you can navigate the digital landscape more effectively and make informed decisions about your investments and creations.

Counter-Strike is a popular first-person shooter game that has captivated millions of players around the world. The game emphasizes teamwork and strategy, as players engage in intense matches between terrorist and counter-terrorist teams. For those looking to enhance their gaming experience, using a daddyskins promo code can provide access to exclusive skins and in-game items.

Digital Assets vs. Traditional Investments: What's the Real Value?

In recent years, the debate between digital assets and traditional investments has intensified. Digital assets, including cryptocurrencies and tokenized assets, offer unique features such as decentralization, accessibility, and liquidity that differ significantly from the more conventional investment avenues like stocks, bonds, and real estate. The real value of digital assets often lies in their ability to provide an alternative investment option with high growth potential, alongside the advantages of being able to trade them 24/7 without the need for intermediaries.

On the other hand, traditional investments have a long-standing history of stability and regulatory oversight, instilling confidence among conservative investors. Assets like real estate often appreciate steadily over time, providing not only potential capital gains but also income through rents. As the financial landscape continues to evolve, understanding the comparative value of both digital assets and traditional investments is crucial for investors looking to diversify their portfolios effectively. Weighing the pros and cons of each can help in making informed decisions tailored to individual risk tolerance and investment goals.

Are You Ready to Invest in Digital Assets? Common Pitfalls to Avoid

Investing in digital assets can be an exciting opportunity, but it comes with its share of challenges. Before diving in, it's essential to recognize some common pitfalls that can derail your investment journey. First and foremost, failing to conduct thorough research is a significant misstep. Many new investors are drawn to the allure of quick profits from cryptocurrencies or NFTs without understanding the underlying technology or market trends. To mitigate this risk, make sure to educate yourself on the various types of digital assets, current market dynamics, and the overall economic factors that could influence their value.

Another critical pitfall is neglecting the importance of security in handling digital assets. Since these investments are primarily held online, they are vulnerable to hacking and fraud. Always utilize secure wallets, enable two-factor authentication, and diversify your holdings to reduce risk. Additionally, be wary of emotional decision-making; it's easy to get swept up in market hype or panic during downturns. Instead, have a well-thought-out investment strategy and stick to it, reviewing and adjusting as needed based on logic rather than emotion.