Solar Innovations and Trends

Your source for the latest in solar technology and energy solutions.

Digital Asset Trading: Turning Pixels into Profits Through Creative Swaps

Unlock the secrets of digital asset trading! Learn how to turn pixels into profits with creative swaps and boost your income today!

Understanding the Basics of Digital Asset Trading: What Every Investor Should Know

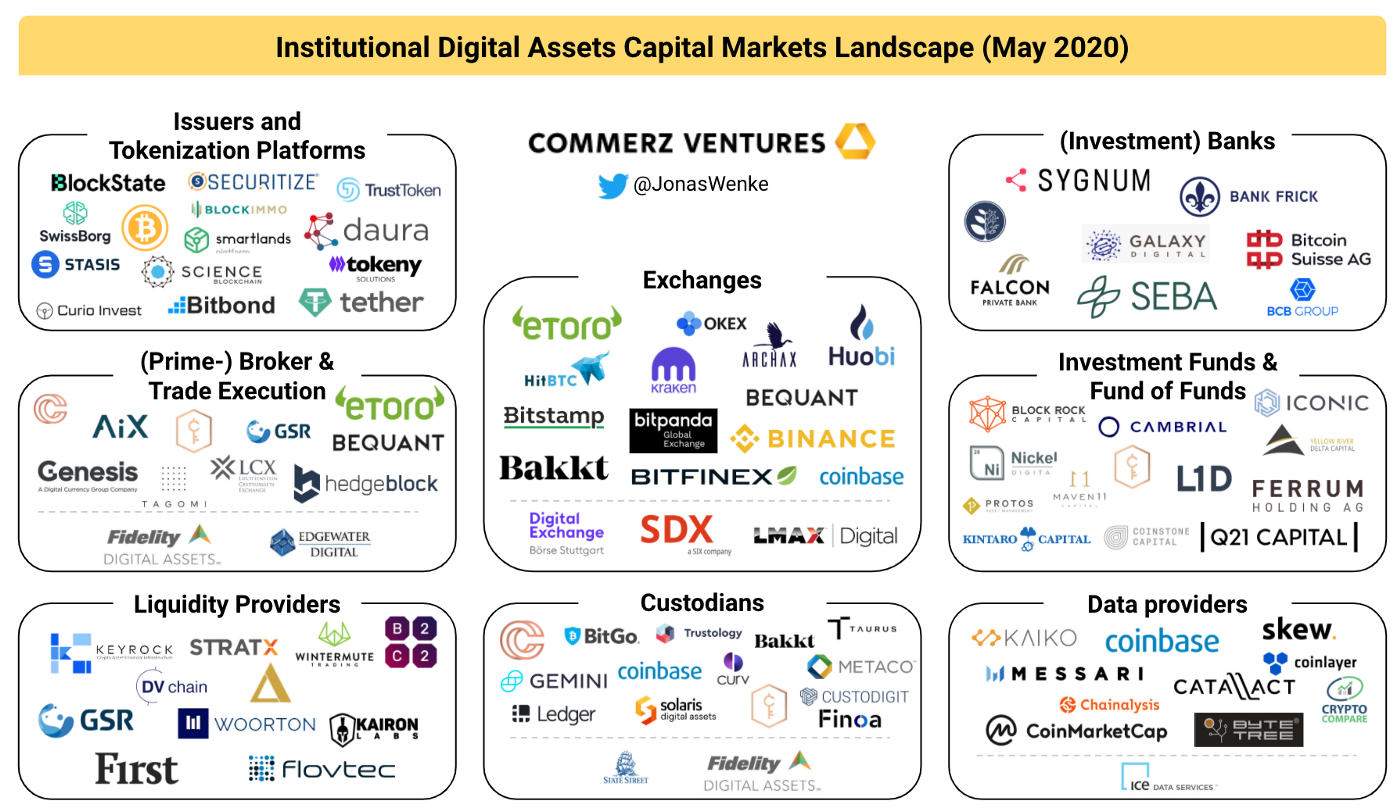

In today's fast-paced financial landscape, digital asset trading has emerged as a prominent investment avenue. Digital assets range from cryptocurrencies like Bitcoin and Ethereum to NFTs (non-fungible tokens) and various other digital representations of value. For investors, understanding the basics of this multifaceted domain is crucial. Key aspects to consider include the nature of the assets, the underlying blockchain technology, and the platforms on which these transactions occur. Familiarizing oneself with terms like wallets, exchanges, and liquidity can significantly enhance an investor's decision-making process.

Before diving into digital asset trading, it is essential to grasp the risks and rewards associated with this investment strategy. Unlike traditional assets, digital assets are often characterized by high volatility, which can lead to substantial gains or losses in short timeframes. To minimize risks, new investors should start with small amounts, employ techniques like dollar-cost averaging, and diversify their portfolios. Additionally, staying informed about market trends and regulatory developments can provide a significant edge. Overall, a solid foundation in digital asset trading not only equips investors with the knowledge needed to navigate the marketplace but also fosters confidence in their investment choices.

Counter-Strike is a popular tactical first-person shooter game that emphasizes teamwork and strategy. Players compete in various game modes, aiming to complete objectives such as defusing bombs or rescuing hostages. For those looking to enhance their gaming experience, using a daddyskins promo code can provide exciting rewards and incentives.

Top Strategies for Successfully Trading Creative Digital Assets

Trading creative digital assets requires a strategic approach to maximize potential returns. One of the top strategies involves thorough market research. Understanding current trends, such as popular art styles and emerging platforms, can provide traders with valuable insights. Utilizing tools such as analytics software and social media trends can help in identifying which digital assets are gaining traction. Additionally, staying updated with news in the blockchain and cryptocurrency space will allow traders to adapt to market shifts promptly.

Another essential strategy is to diversify your portfolio. By trading a variety of creative digital assets, such as NFTs, virtual real estate, and digital collectibles, traders can mitigate risks associated with market volatility. It's important to invest in a mix of established and emerging assets to balance potential high rewards with lower risk. Lastly, engaging with online communities and forums can also provide traders with tips and real-time feedback, further enhancing their trading strategies.

How to Evaluate the Value of Your Digital Assets Before Swapping

Evaluating the value of your digital assets is crucial before engaging in any swap. Start by considering market trends and recent sales data for similar assets in your niche. Analyzing platforms like OpenSea or Rarible can provide insight into current valuations. Additionally, assess the utility of your asset, as items with functional uses often carry higher worth. Create a checklist of factors such as rarity, demand, and historical performance to guide your evaluation process.

Once you have gathered initial data, it is essential to validate your findings. Reach out to fellow traders or seek advice from experts within your community. Engaging in discussions on forums and social media can reveal different perspectives that may affect your asset's value. Don't forget to consider potential future developments in the market that might impact demand. By taking a comprehensive approach that combines quantitative data and community insights, you'll be better positioned to make informed swapping decisions.